Insurance Coverage

Cost avoidance efforts start with the most accurate and up to date coverage information.

We’ve got you covered.

Falling down a rabbit hole of conflicting coverage information? Our third party liability (TPL) experts are here to help you obtain the most accurate coverage information and ensure that you are maximizing your reimbursements while remaining compliant with Medicaid regulations. Our cutting-edge software solutions are designed to simplify the process of identifying third party liability insurance coverage, reducing the risk of claim denials while focusing on cost avoidance efforts.

We’re confident that we can provide you with the support and solutions you need to improve your Medicaid Management Information System (MMIS) coverage accuracy, enabling you to maximize your cost avoidance and recoveries.

Support for you and those you serve.

It’s not just about the returns. It’s about what those returns mean for your community.

By helping you obtain and manage coverage data, we ensure all the information is accurate to avoid issues with beneficiaries accessing care. Cost avoidance efforts are driven by swiftly identifying commercial coverage through our real-time, intelligent data. Through our existing TPL technologies, we can create a comprehensive solution for insurance coverage or support your legacy software with new features.

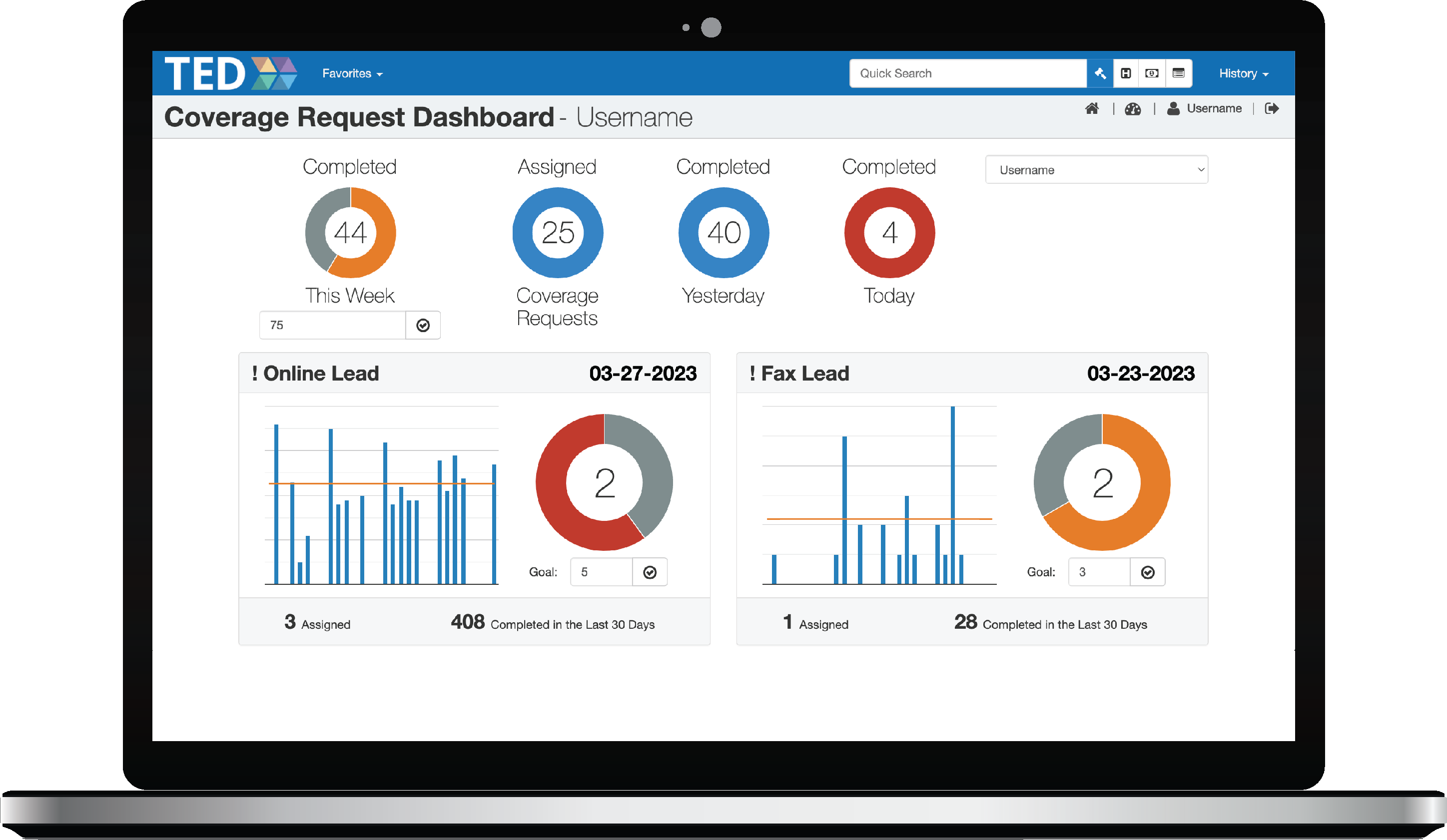

Coverage Monitoring Dashboards

Stay informed in real time and easily track key statistics with custom dashboards created to monitor coverage numbers or changes.

- Proactively identify and address issues in automated processes.

- Increase transparency and communication with easily generated reports and graphs around your coverage data.

- Track significant changes, trends, and patterns all in one place with user-friendly oversight dashboards.

Coverage Monitoring Dashboards

Stay informed in real time and easily track key statistics with custom dashboards created to monitor coverage numbers or changes.

- Proactively identify and address issues in automated processes.

- Increase transparency and communication with easily generated reports and graphs around your coverage data.

- Track significant changes, trends, and patterns all in one place with user-friendly oversight dashboards.

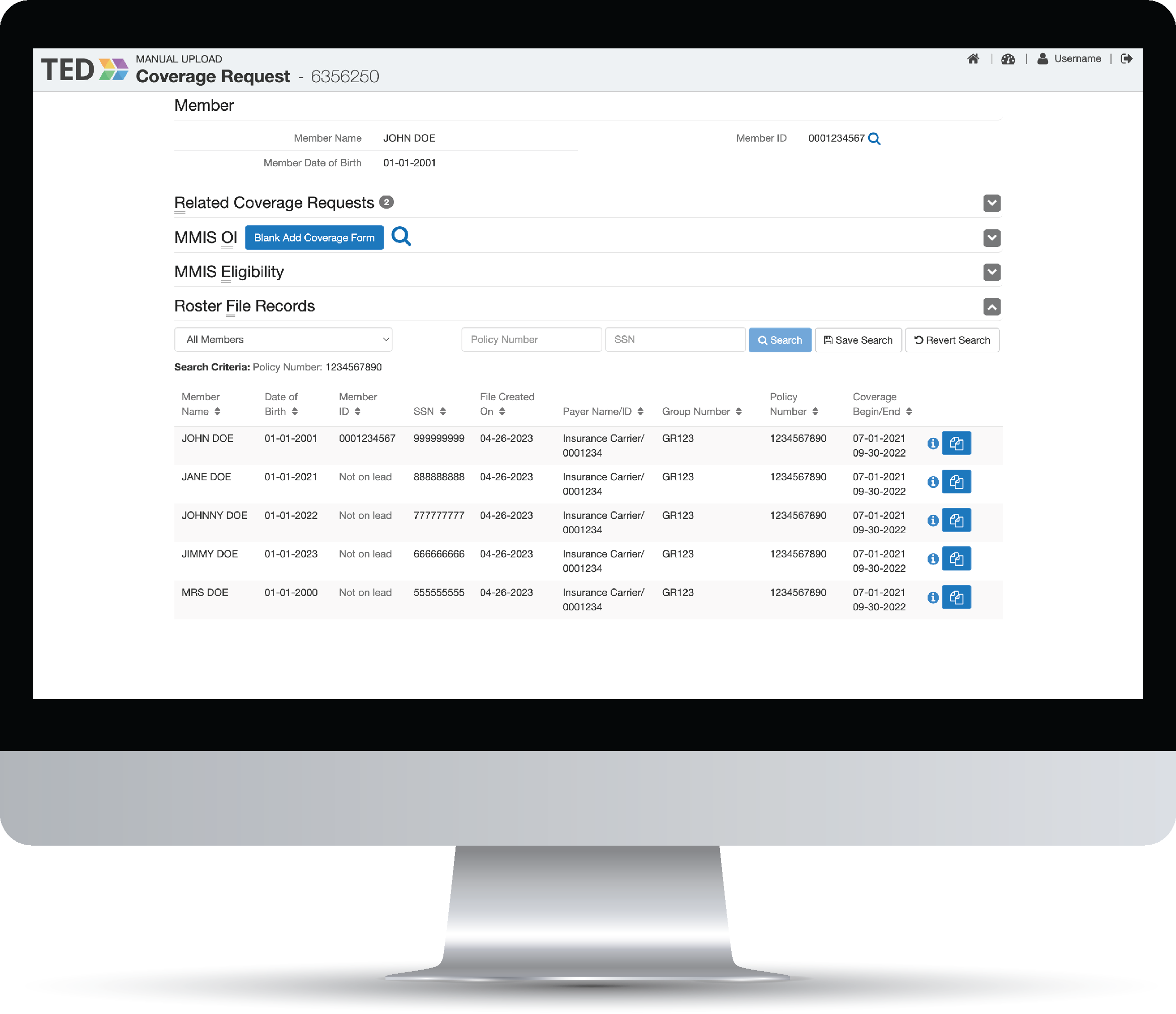

Coverage Lead Identification

Bulk up your cost avoidance efforts and reduce access to care issues for beneficiaries by identifying situations and correcting missing or incorrect coverage used by your MMIS.

- Mitigate the need for post payment recovery with access to the most up to date and intelligent data that can be acted on to cost avoid.

- Easily identify, review, and correct potential lapses or incorrect coverage information.

- Ensure Medicaid beneficiaries receive the coverage they need with better coverage quality in your MMIS.

Payer Onboarding Support for Coverage Files

Nothing gets lost in translation here when you can map coverage files from insurance companies to custom formats that can be easily transferred to your MMIS.

- Efficiently onboard payers ensuring that they can start submitting updated information more quickly and frequently.

- Lessen the need for manual intervention or periodic source updates with electronic data interchange (EDI) and real time web services.

- Improve revenue cycle management by reducing the time it takes to collect reimbursements for services provided to those with third party coverage.

Payer Onboarding Support for Coverage Files

Nothing gets lost in translation here when you can map coverage files from insurance companies to custom formats that can be easily transferred to your MMIS.

- Efficiently onboard payers ensuring that they can start submitting updated information more quickly and frequently.

- Lessen the need for manual intervention or periodic source updates with electronic data interchange (EDI) and real time web services.

- Improve revenue cycle management by reducing the time it takes to collect reimbursements for services provided to those with third party coverage.

Coverage Matching

Conveniently match coverage files from insurance companies to Medicaid members in your state. With more accurate coverage information, you’ll be able to cost avoid and lighten the workload for post-payment subrogation.

- Streamline the coordination of benefits for Medicaid beneficiaries through quick and accurate coverage matching in your MMIS.

- Increase reimbursements to your Medicaid program by identifying more beneficiaries with available third party insurance coverage.

- Reduce the time and effort required to manually verify coverage information and minimize rejections due to incorrect data.

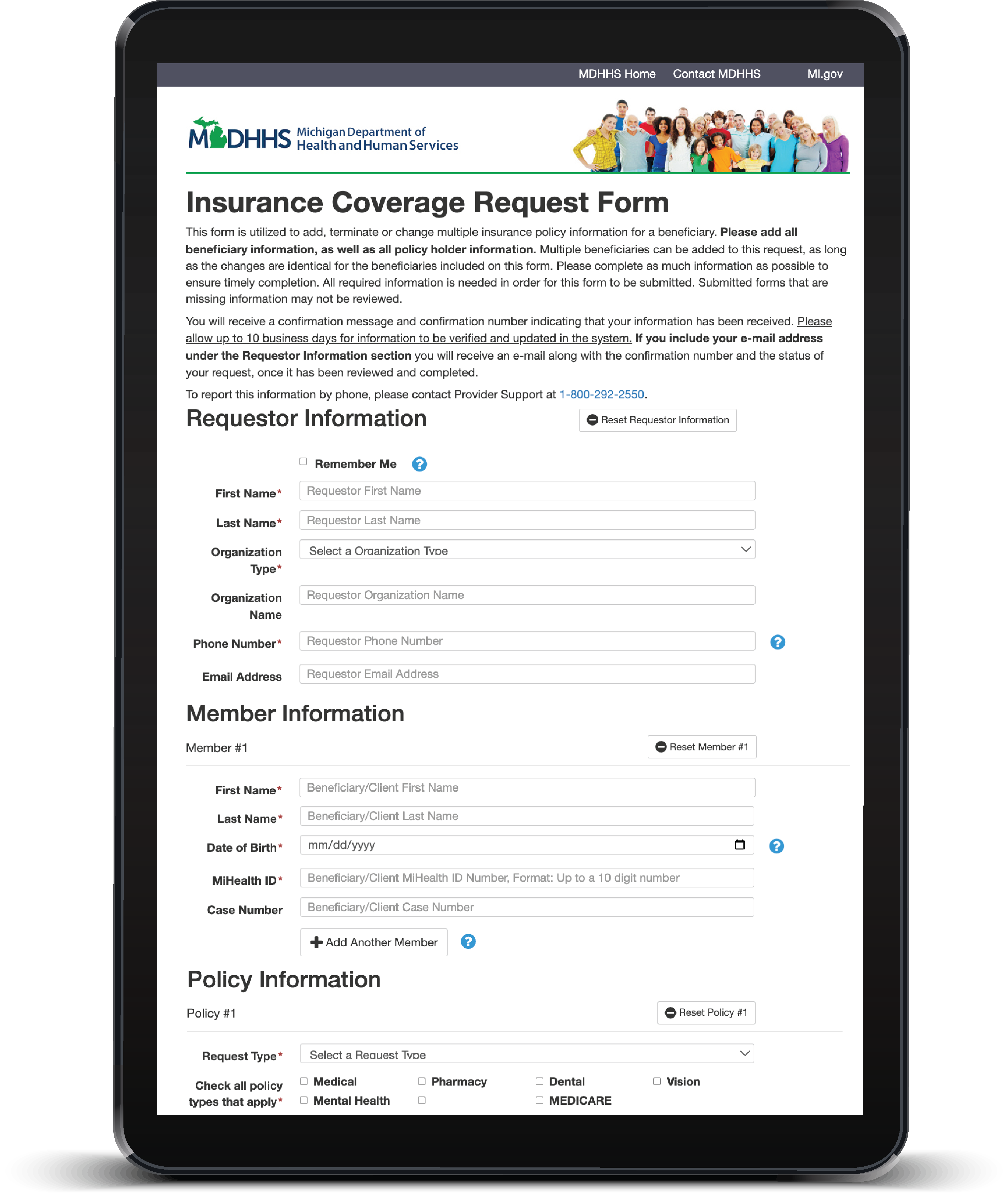

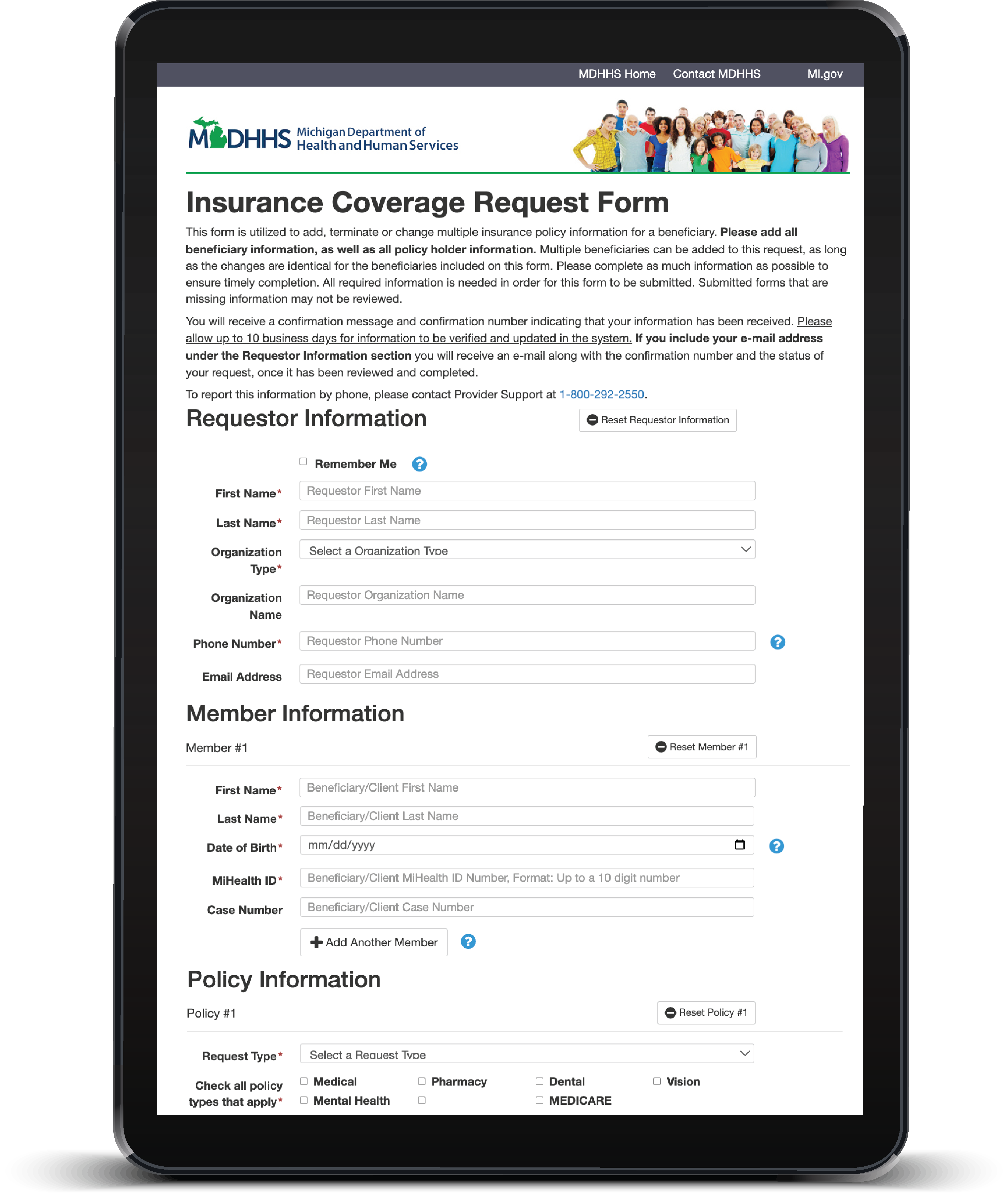

Public Portal for Coverage Submission

Put your running shoes away, the chase for information is over. Reduce the workload by validating coverage information submitted online by beneficiaries and providers to add to the MMIS.

- Enable your staff to easily review submissions to help identify trends in missing coverage through user-friendly interfaces.

- Improve your coverage information quality and accuracy by adding approved submissions to your MMIS.

- Easily search for coverage information, updated in real time.

Public Portal for Coverage Submission

Put your running shoes away, the chase for information is over. Reduce the workload by validating coverage information submitted online by beneficiaries and doctors to add to the MMIS.

- Enable your staff to easily review submissions to help identify trends in missing coverage through user-friendly interfaces.

- Improve your coverage information quality and accuracy by adding approved submissions to your MMIS.

- Easily search for coverage information, updated in real time.

Take a look at the big picture.

With our team of experts on your side, we can build a newly modernized solution or enhance your legacy software to improve your MMIS data that will help you make informed decisions and maximize your returns. When it comes to TPL insurance coverage needs, we’re here to help states with cost effective analysis.

Drive Cost Avoidance

Our solutions drive cost avoidance by gathering data to supply your MMIS with the information needed to prevent future improper payments. More accurate data will help resolve unavoidable pay and chase claims quickly, providing the maximum return possible.

Curate The Specifics

No matter which insurance companies you work with, what format you prefer your files in, or to what extent you require each feature or service, we can tailor everything to your needs.

Support Your Community

Better coverage matching means more opportunity for cost avoidance savings and returns that will go back into your state’s Medicaid program to help more beneficiaries get the care they need.

Increase Recoveries

With more access to accurate information, less claim leads will go unnoticed, payers can be identified faster and the quicker you will be able to complete the billing process.

Looking for more?

We understand that coverage matching may just be one part of your larger TPL responsibilities. Our comprehensive Medicaid third party liability services are modularly designed to be set up exactly the way you need them.

HEALTH SUBROGATION

Put more money back into your Medicaid program with a streamlined claim billing and resolution process.

VENDOR OVERSIGHT

We can help you verify coverage data from vendors too! Oversee and stay informed on work output for your team, vendors, and even us.

Don’t let conflicting information overload your system or your brain.

Let’s build a solution that will take the headache out of the coverage matching process.